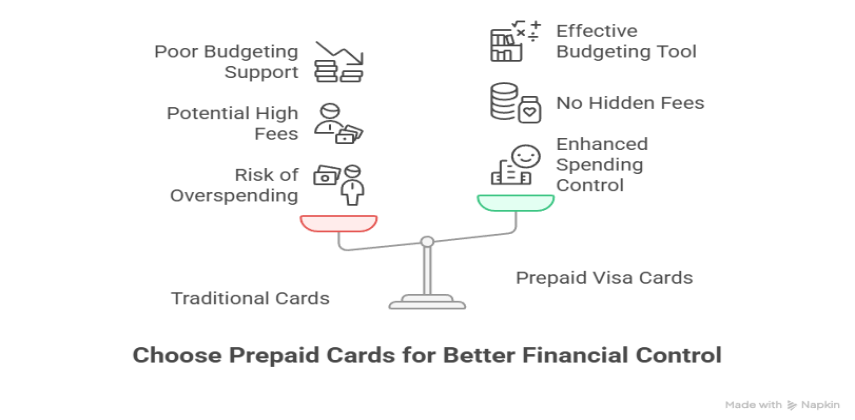

In today’s fast-paced world, managing personal finances can be a challenge. Traditional debit and credit cards offer convenience, but they can also lead to overspending, high fees, and poor budgeting. Reloadable prepaid Visa cards provide a smarter alternative by offering an easy way to control your spending and help with budgeting. With the ability to load money onto the card and spend only the balance available, these cards act as a powerful tool for anyone looking to manage their finances better.

Whether you’re working on a tight budget or just prefer the security of pre-loaded funds, reloadable prepaid Visa cards offer a range of benefits. In this blog, we’ll explore how you can use these cards to budget and manage your finances more effectively.

A reloadable prepaid Visa card is a type of prepaid card that allows you to load funds onto the card, use it for purchases, and then reload it once the balance runs low. Unlike traditional credit and debit cards, a reloadable prepaid Visa card does not link directly to a bank account or line of credit. Instead, it functions on the principle of preloading a specific amount of money onto the card, which you can spend until the balance reaches zero. Once the card is used up, you simply reload it with more funds, making it a flexible and convenient financial tool.

These cards are ideal for managing personal finances, as they offer a controlled and simple way to handle money without worrying about overdrafts or high-interest rates. You can use a reloadable prepaid Visa card for everyday purchases, online shopping, and even bill payments, much like any other Visa card. However, unlike credit cards, you can only spend the amount that has been preloaded, helping to prevent overspending and keep your budget in check.

At Virtual Card Palace, we offer a variety of reloadable prepaid Visa cards, including options like the Visa Debit Reloadable Card and Virtual Visa Cards. These cards provide not only flexibility but also enhanced security features, making them a smart choice for managing your finances without the complexities of traditional banking systems.

When it comes to managing personal finances, a reloadable prepaid Visa card is one of the most efficient tools available. These cards offer a unique set of advantages that can help individuals maintain control over their spending while sticking to a budget. Whether you're trying to manage everyday expenses or save for a specific goal, reloadable prepaid Visa cards provide a smart and convenient solution. Here’s how these cards can benefit your budgeting efforts.

One of the primary benefits of using a reloadable prepaid Visa card is the ability to control your spending. Unlike traditional credit cards, which may tempt you to overspend, prepaid Visa cards are limited to the amount of money you load onto them. This ensures that you can only spend what you’ve preloaded, preventing unexpected overdrafts or going over budget. This makes it an ideal option for people who find it difficult to track spending on traditional credit or debit cards.

By setting a specific amount for the card, you can ensure that you don’t exceed your monthly budget. With many reloadable prepaid Visa cards, you also have access to online banking or mobile apps that help track every purchase, giving you a real-time view of your spending. This feature makes it much easier to stick to your financial goals and prevent impulsive spending.

For a convenient solution, Virtual Card Palace offers a variety of reloadable prepaid Visa cards, including options like the Visa Debit Reloadable Card, which can be preloaded and tracked with ease.

Unlike traditional credit cards that often come with hidden fees or interest charges, reloadable prepaid Visa cards help you avoid these additional costs. Since you are only spending the money that has been loaded onto the card, there are no interest fees associated with your purchases. Additionally, many prepaid cards offer a transparent fee structure, meaning you will know upfront how much you’ll be charged for reloading or using the card.

This makes reloadable prepaid Visa cards an excellent choice for those who want to avoid unexpected charges. With no debt accumulation and no high-interest rates, you can manage your finances without the financial burden of traditional banking services.

At Virtual Card Palace, we offer several options like the Visa Debit Reloadable Card with clear fee structures to help you make the most of your budgeting efforts.

Using a reloadable prepaid Visa card is an effective way to build financial discipline. By preloading only a specific amount onto your card, you are essentially creating a clear boundary for your spending. This encourages better decision-making and a more mindful approach to purchases.

Over time, you can use the card as a tool to save for specific goals. For example, you can create separate cards for different purposes: one for daily expenses, one for savings, and one for discretionary spending. This makes it easier to track your progress and see where you might need to make adjustments to stay on target.

To make it even easier to achieve your financial goals, Virtual Card Palace offers virtual Visa cards that can be used for specific purchases or as a savings tool, helping you track your savings goals with greater precision.

Reloadable prepaid Visa cards offer better security than carrying cash or using traditional bank accounts. These cards come with features such as PIN protection, fraud alerts, and the ability to freeze or lock your card in case of loss or theft. This makes them a safer option for managing finances.

With the ability to track every transaction and immediately flag any unauthorized charges, reloadable prepaid Visa cards offer enhanced security compared to carrying cash or using debit cards, which can be more vulnerable to fraud.

At Virtual Card Palace, we take security seriously. Our reloadable prepaid Visa cards come equipped with robust security features to protect your funds, ensuring that you can manage your budget without the fear of losing your money to fraud.

Managing daily expenses can be a challenge, especially with the temptation to overspend or lose track of your budget. Reloadable prepaid Visa cards provide an excellent solution to help you stay on top of your finances and keep your spending in check. With these cards, you can maintain better control over your daily expenses without the risk of accumulating debt or relying on credit. Here’s how they can help you manage your daily expenses effectively.

One of the key advantages of using a reloadable prepaid Visa card is that it allows you to set a fixed budget for your daily expenses. Unlike credit cards, which can encourage overspending by offering a revolving balance, prepaid cards only allow you to spend what you load onto the card. This feature makes it easier to stick to a budget since you can’t exceed the amount on your card.

For example, you can load a specific amount onto your reloadable prepaid Visa card each week for essentials like groceries, transportation, and dining. By setting clear boundaries on your spending, you avoid unnecessary impulse purchases and can better control how your money is spent.

Virtual Card Palace offers a variety of reloadable prepaid Visa cards like the Visa Debit Reloadable Card and Visa Debit Card, which can be used for everyday expenses. You can easily reload these cards as needed, giving you complete control over your spending.

With a reloadable prepaid Visa card, you can track your spending in real-time using mobile apps and online banking features. This allows you to see where your money is going and make adjustments as needed. Many prepaid card providers, including Virtual Card Palace, offer intuitive apps that enable you to monitor transactions, check your balance, and receive notifications when you approach your spending limit.

Tracking your daily expenses becomes much easier when you can instantly view every purchase and categorize your spending. This feature helps you identify areas where you might be spending more than planned and adjust your habits to stay within your budget.

One of the common pitfalls of using traditional bank accounts or credit cards is the risk of incurring fees and interest charges. Reloadable prepaid Visa cards eliminate these risks by providing a fee structure that is easy to understand. There are no hidden interest rates or penalty fees for overspending because you can only spend the funds that have been preloaded onto the card.

With reloadable prepaid Visa cards, you also avoid overdraft fees, which are common with debit cards linked to bank accounts. This makes them a safer and more cost-effective choice for managing your daily expenses.

For more options, explore the Reloadable Visa Card available at Virtual Card Palace, designed to help you stay on top of your daily spending without any unwanted fees.

A reloadable prepaid Visa card offers the flexibility to be used for both online and in-store purchases, making it ideal for managing daily expenses in a variety of settings. Whether you’re buying groceries from a local store or shopping for clothes online, you can use your reloadable prepaid Visa card just like a regular debit or credit card.

This flexibility ensures that you can manage all of your expenses from one card, whether it’s for everyday items or more significant purchases. The card is accepted everywhere Visa is accepted, which further simplifies the process of tracking and managing your daily expenses.

Additionally, Virtual Card Palace offers virtual Visa cards like the Virtual Visa, which are perfect for online transactions. These cards work seamlessly for online shopping, helping you manage your daily expenses digitally with ease.

When it comes to managing money, security is a top concern. Traditional payment methods such as cash or debit cards can leave you vulnerable to theft, loss, or fraud. However, reloadable prepaid Visa cards offer enhanced security features that make them a safer option compared to cash or debit cards. Here’s how reloadable prepaid Visa cards provide peace of mind and ensure your funds are protected.

One of the most significant advantages of using a reloadable prepaid Visa card is the protection it offers in the event of loss or theft. If you lose cash or your debit card, it can be challenging to recover the funds, and your bank account may be at risk. In contrast, reloadable prepaid Visa cards are protected by PIN codes and account lock features that allow you to immediately freeze or lock your card if it’s lost or stolen. This minimizes the risk of someone else using your card and accessing your funds.

Many prepaid Visa card providers, including Virtual Card Palace, offer the ability to lock or unlock your card through a mobile app, so you have complete control over its security. Additionally, if your card is lost or stolen, you can contact the issuer for a replacement, ensuring that your funds are not compromised.

For example, our Visa Debit Reloadable Card comes with robust fraud protection features to help safeguard your account.

Reloadable prepaid Visa cards offer advanced fraud protection features that help detect and prevent unauthorized transactions. Most prepaid cards come with 24/7 monitoring, alerting you to suspicious activity in real time. This means that if someone attempts to make an unauthorized purchase, the card issuer can take immediate action to block the transaction and protect your account.

Moreover, many reloadable prepaid Visa cards offer transaction alerts via text message or email, notifying you whenever your card is used. This allows you to keep a close eye on your spending and quickly spot any fraudulent activity.

At Virtual Card Palace, we provide cards like the Visa Debit Card with enhanced fraud detection systems that monitor transactions and alert you to any unusual activity. This ensures that your finances remain secure and under your control.

Unlike debit cards, which are linked directly to your bank account, reloadable prepaid Visa cards are not connected to your personal banking information. This significantly reduces the risk of someone gaining access to your entire bank account if your card details are compromised. With a reloadable prepaid Visa card, you are only at risk of losing the funds loaded onto the card—nothing more.

This separation from your bank account provides an added layer of security, especially if you’re worried about online fraud or hacking. For more peace of mind, consider using Virtual Card Palace’s Virtual Visa Cards, which can be used for online transactions without linking to your primary bank account, further minimizing your exposure to financial risk.

When it comes to online shopping, using reloadable prepaid Visa cards is a much safer alternative to traditional debit or credit cards. Many prepaid cards, including those from Virtual Card Palace, offer virtual Visa cards that are designed specifically for online transactions. These cards are issued with unique account numbers for each purchase, ensuring that your primary card details are never exposed to online merchants.

Additionally, these cards come with EMV chip technology, which adds an extra layer of security when making in-person purchases, helping to protect your card from being cloned or compromised.

Managing your finances effectively requires discipline, strategy, and the right tools. Reloadable prepaid Visa cards are an excellent resource for individuals looking to stay on track financially. These cards provide a controlled way to manage spending while ensuring that you don’t fall into the trap of overspending. Here are some practical tips for using your reloadable prepaid Visa card to achieve financial success.

One of the best ways to stay on track financially is by setting a budget for each spending category. With reloadable prepaid Visa cards, you can easily allocate a specific amount of money for categories like groceries, entertainment, transportation, and savings. By loading a fixed amount onto your card for each category, you prevent yourself from overspending and stay within your limits.

For example, you could load $200 onto your Visa Debit Reloadable Card for groceries, $50 for entertainment, and $100 for transportation. As you make purchases, you’ll have a clear view of how much money you have left in each category, making it easier to adjust your spending habits.

Virtual Card Palace offers a variety of reloadable prepaid Visa cards, like the Visa Debit Reloadable Card, which makes budgeting and tracking your expenses simple and effective.

One of the most effective ways to ensure that your prepaid Visa card is always ready for use is by setting up automatic reloads. This feature is available with many reloadable prepaid Visa cards and allows you to set a regular interval for reloading your card, whether it’s weekly, bi-weekly, or monthly. This automation removes the guesswork from your finances and ensures that you’re never caught without enough funds.

By setting up automatic reloads, you can easily stick to your budget and avoid running out of money unexpectedly. This is particularly useful if you rely on your card for daily expenses like groceries and gas.

At Virtual Card Palace, we offer flexible options for reloading your Visa Debit Reloadable Card. You can choose to load funds automatically or manually, depending on your preference and financial goals.

Most reloadable prepaid Visa cards come with mobile apps that make tracking your spending easier than ever. By using these apps, you can monitor your transactions in real-time, categorize your purchases, and set up notifications to alert you when you're approaching your spending limit.

This level of visibility allows you to stay on top of your finances and make adjustments to your spending habits as needed. For example, if you notice that you’re spending more on dining out than planned, you can take corrective actions to reduce your expenses.

Virtual Card Palace offers a comprehensive mobile app for its Visa Debit Reloadable Cards, giving you the tools you need to stay on top of your budget and make informed financial decisions.

A great way to manage your finances with reloadable prepaid Visa cards is by using different cards for different purposes. For instance, you can have one card for daily expenses like food and gas, another for savings, and a third for entertainment or discretionary spending. By splitting your finances across multiple cards, you’ll be able to clearly see how much you’re spending in each category and adjust accordingly.

Using multiple cards also helps prevent accidental overspending. If one card runs out of funds, you can simply rely on another card without worrying about exceeding your overall budget. Virtual Card Palace offers various options, including Virtual Visa Cards, which can be used for online purchases, further helping you organize and track your expenses.

One of the best ways to control your spending habits is by using a reloadable prepaid Visa card with a set amount of money. Since you can only spend what is loaded onto the card, you’re less likely to fall victim to impulse purchases. This is particularly important for people who struggle with maintaining a budget.

For example, if you’re shopping online, use a virtual prepaid Visa card for a set amount, and once the balance runs out, you’ll know it’s time to stop. This tactic encourages mindful spending and helps you stay focused on your financial goals.

Virtual Card Palace offers a variety of prepaid card options that allow you to load a fixed amount of funds and keep track of your remaining balance. Whether it’s for daily expenses or specific purchases, these cards help you avoid overspending.